what is a provisional tax code

2500 before the 2020 return. 2 If your provisional income exceeds these thresholds youll compare 50 of your benefits amount to 50 of your provisional income that exceeds the threshold.

Pin By Swapna On Imp Lowercase Alphabet Lowercase A Lettering

Provisional tax allows the tax liability to be spread over the relevant year of assessment.

. Provisional taxpayers are required to submit two provisional tax returns during the tax year and make the necessary payment to SARS if a payment is due on the return. If you earn non-salary income for example rental income from a property interest income from investments or other income from a trade or small business you run you will be a provisional taxpayer even if you ALSO earn a. When the year is audited and.

Provisional tax is a way of paying your income tax in instalments during the year. A third payment is optional after the end of the tax year but before the issuing of the assessment by SARS. Provisional taxpayers have to complete a provisional tax return IRP6 twice a year.

The first provisional tax return must be submitted within the first 6 months of the year and the second provisional tax return at the end of the year of assessment. This means that they are not employed but get some form of regular income. Youll pay tax on whichever amount is smaller.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the previous tax year and calculated for 12 months and requires prepayment for the next tax. 2500 before the 2020 return. Provisional tax helps you manage your income tax.

The assessment and the payment of the 1 st installment can be created via Tax Portal. Self Employed people rental property owners and people who earn non-PAYE income need to pay their own income tax. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year of assessment.

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which are based on estimated taxable income. What is provisional tax. Provisional tax is not a separate form of tax.

Everyone pays income tax if they earn income. 0 if youre married filing a separate return and lived with your spouse at any time during the tax year. Youll have to pay provisional tax if you had to pay more than 5000 tax at the end of the year from your last return.

Provisional tax is income tax you pay in instalments during the year. You pay provisional tax if your tax bill for the last tax year is more than 5000 previously 2500. It is income tax paid in advance during the year because of the way you your company or your trust earns its income.

The definition according to the first paragraph of the 4th Schedule of the Income Tax Act No58 of 1962 is that any. A provisional taxpayer is a person whose income accrues through other means other than salary. Provisional tax is not a separate tax.

It is in fact one of the methods used by the South African Revenue Service SARS to collect tax. Provisional tax helps you manage your income tax. Provisional income calculations can get a bit complex though it is all laid out in 86 of the Internal Revenue Code IRC.

It is paid by two equal installments on the 31 st of July and 31 st of December of each year in two equal installments for the given year. A provisional taxpayer is required to pay instalments of income tax called provisional tax during the income year rather than at the end of the year when a tax return is filed. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer.

The purpose is to decrease the amount of tax paid by the taxpayers in one amount. Provisional tax helps you to spread the load to. Provisional tax is not a separate tax.

PROVISIONAL TAX What is this tax. What Is Provisional Tax IRP6 IRP6 is the abbreviation used for the provisional return completed by the taxpayer to declare their estimated taxable. You pay it in instalments during the year instead of a lump sum at the end of the year.

The provisional tax is actually the payment in advance of this years income tax. Its payable the following year after your tax return. This obligation to pay provisional tax can arise in addition to the taxpayers employer deducting tax.

It requires the taxpayers to pay at least two amounts in advance during the year of assessment which is based on estimated taxable income. What is provisional tax. Its payable the following year after your tax return.

Skillselect Invitation Round Held On May 2019 For Subclass 189 And 489 Australia Immigration Hold On Invitations

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax

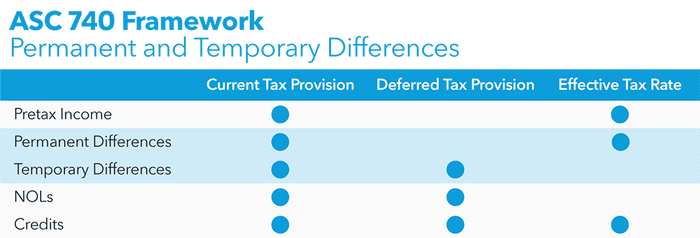

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Income Tax Department Recruitment 2021 Incometaxindia Gov In

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Bmc Prepares To Go Cashless Oppn Sceptical About Success Developing Country Property Tax Success

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

W9 Forms 2021 Printable Irs Tax Forms Irs Forms Irs

Italian Tax Code Codice Fiscale Studio Legale Metta

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

Engagement Of A Consultant In The Department Of Pension Pensioners Welfare Central Government Employees News

Best Startup Solutions Company Registration In India Complypartner Start Up Startup Company Digital Marketing Services

Corporate Income Tax And Provisional Tax Obligations For Small Businesses Youtube

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Clarification To Pensioners About Suggestion To Hike Exemption Limit To Rs 5 Lakhs

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Limited Liability Partnership Registration In Trivandrum Llp Parpella

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Intellectual Property Firms How To Protect Intellectual Property Provisional Patent Application Intellectual Pro Invention Patent Inventions Financial Literacy